Clergy Residence Deduction

If you are a clergy member in Canada, you are eligible for the clergy residence deduction (CRD) taxable benefit. This benefit is only intended for traditional clergy roles where theological training is required and religious duties are expected from the role. Do not include program director roles in this benefit. Abuse of this benefit threatens your CRA standing and the ongoing use of the benefit for those who are eligible.

The CRD is a financial benefit as it allows for the fair market rental value of your home to be excludable from your gross income for taxation purposes. The amount is based on either the fair rental value of your home or the amount of rent you are paying. The deduction reduces the amount of tax and CPP that you are required to pay.

Deduction Options

You have two options in how you receive your tax deductions from this benefit. You can receive the tax benefits at the time of your annual return or you can claim it at source. However, if your church is using our denominational payroll services, the only option available is to claim your deduction at the time of your annual tax return.

1. CLAIMING AT ANNUAL TAX RETURN

The simpler method is to claim your CRD at the time of filing your annual tax return as it only requires the completion of one form, the T1223. For links to forms and instructions, refer to the section below.

2. CLAIMING AT SOURCE

Not available for those on the BIC payroll services.

Important Notes

It is the responsibility of the senior pastor to ensure that all church staff who are eligible to claim the CRD are provided the guidelines outlined on this webpage, as well as the required forms.

There is a required level of due diligence by the employer (Church Board) to ensure that the employees (pastors, staff) meet the conditions set for claiming the CRD before signing the Employer Certification section of form T1223. This is on a ‘to the best of my knowledge’ basis and does not require the employer to verify the employee’s claim unless the employer has existing knowledge that the claim is inaccurate. The form must be filled in accurately by both the employee and the employer.

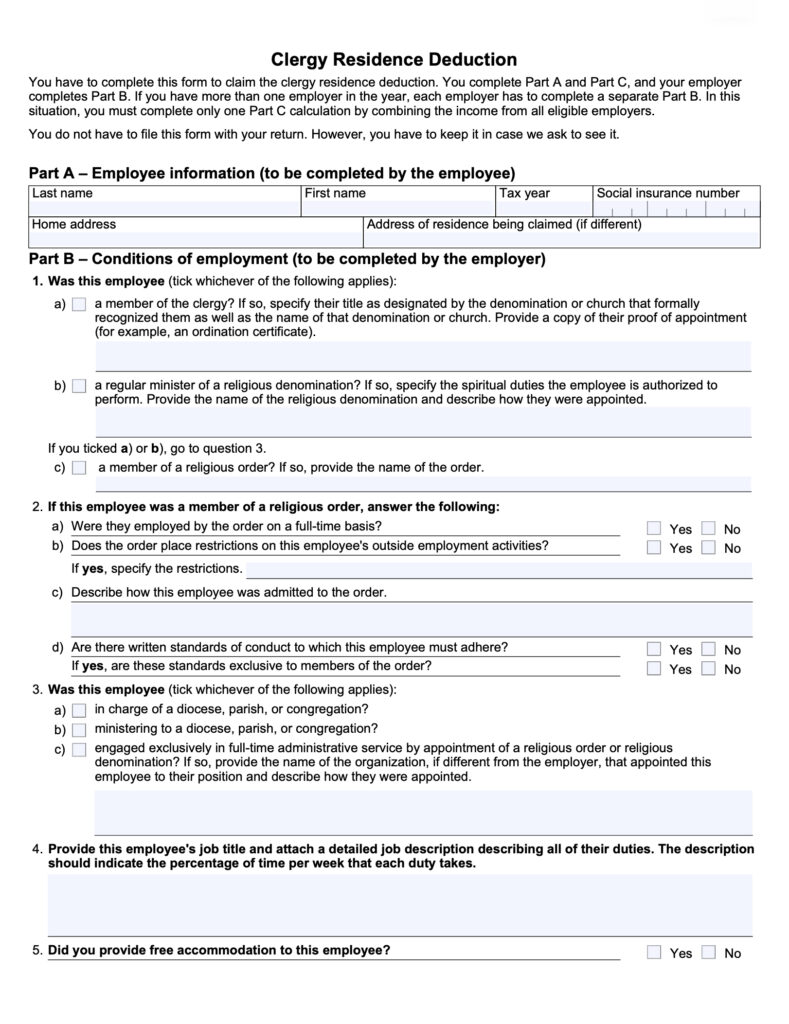

T1223 - Clergy Residence Reduction

PART B

QUESTION ONE

This question determines if you have a valid status within our denomination to qualify for the CRD.

Box A : Because our denomination only approves clergy for CRD, you should select Box A. Examples of titles could include Senior Pastor, Lead Pastor, Pastor of Children’s Ministry, etc. Proof of your appointment could include a copy of your BIC license card.

QUESTION THREE

This question determines if you have a valid function within our denomination to qualify for the CRD.

Box A : This applies if you are in charge of a congregation and have administrative and spiritual oversight, typically the Senior Pastor.

Box B : This applies to other pastoral staff roles that are not the Senior Pastor.

Box C : This applies if you are a full-time administrator who determines policies and coordinates various religious activities for the organization at the management level.

EMPLOYER CERTIFICATION

The person authorized to complete this section could be the church treasurer or board chairperson.

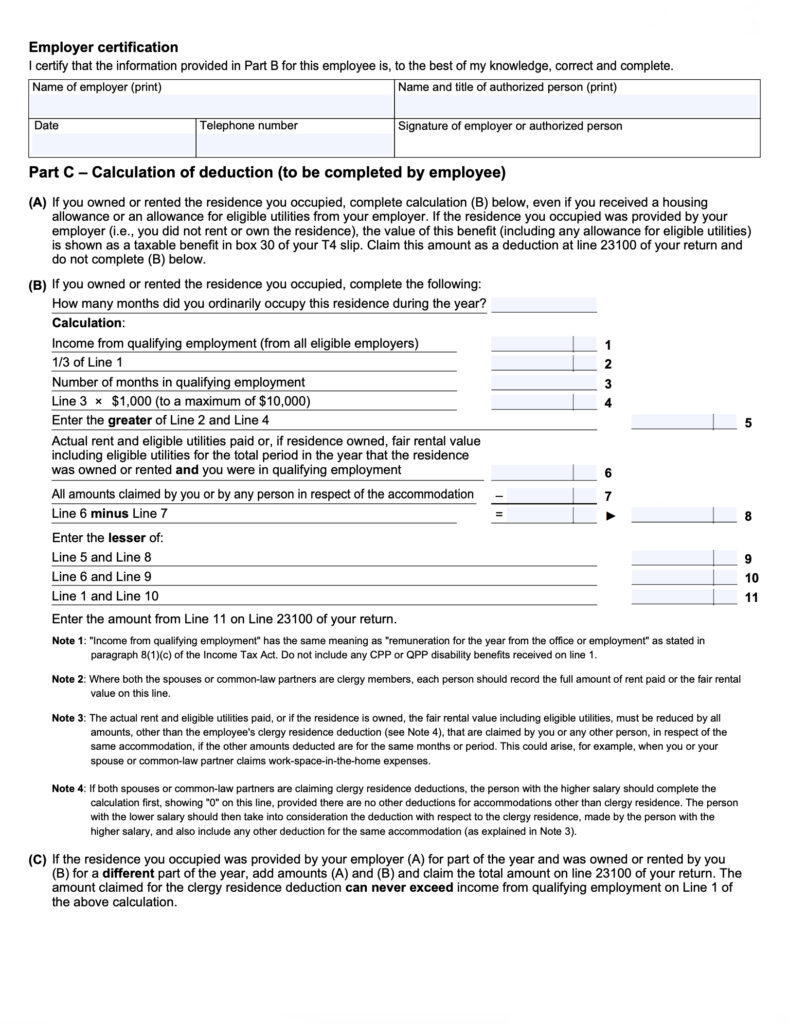

PART C

If you own your house, you can often get a free assessment of fair market rental value for your home from a local realtor.